Tax breaks can be a significant benefit to homeowners who are planning to build new homes. By taking advantage of the tax incentives available for new home construction, homeowners can save money and enjoy a more comfortable living environment. In this article, we will explore the tax breaks available for new home construction projects.

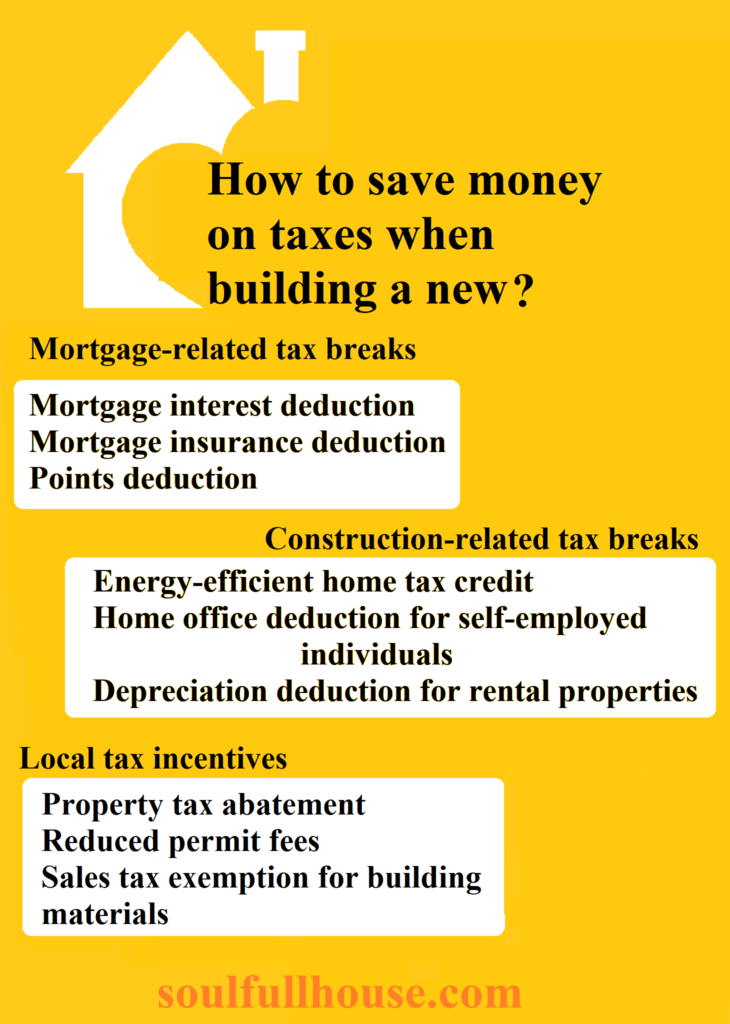

How to save money on taxes when building a new house?

Homebuilders can reduce their tax burden by planning ahead and taking advantage of tax breaks such as deducting interest on construction loans, claiming energy-efficient tax credits, and taking advantage of property tax exemptions. Tax exemptionsadjust the value of the property subject to taxation while tax abatements reduce the total amount of tax owed, generally for a fixed period of time. It is best to consult with a local tax specialist to see which tax breaks are available to you and the criteria for getting them.

Tax breaks are essentially deductions, credits, or exemptions that reduce the amount of taxes you owe. If you’re building a new home, there are a variety of tax breaks available that can help you save money, both during the construction process and after you move in. These tax breaks can help make your new home more affordable and ease the financial burden of building a new home. However, it’s important to understand the criteria for each tax break and to consult with a tax professional to ensure you’re taking advantage of all the tax breaks available to you.

What tax breaks are available for constructing a new house?

There are federal tax breaks both mortgage-related and construction-related, and also there are those given by local authorities. Homebuilders should get to know all available options and apply for which they meet the requirements.

Mortgage-related tax breaks

Mortgage-related tax breaks can help you save money on your monthly mortgage payments. Here are some of the tax breaks you may be eligible for:

Mortgage interest deduction

One of the most common tax breaks for homeowners is the mortgage interest deduction. This incentive allows homeowners to deduct the interest they pay on their mortgage from their taxable income, reducing their tax burden. For new home construction projects, this deduction can be especially valuable. Homeowners can deduct the interest they pay during the construction process, as long as the home is completed within 24 months of the start of construction; have a mortgage on primary residence or a second home; and additionally, the mortgage must be for a maximum amount of $750,000. It’s important to keep accurate records of your mortgage interest payments, as you’ll need to report the amount of interest paid on your tax return. You should receive a Form 1098 from your mortgage lender, which will show the amount of interest you paid during the year.

Mortgage insurance deduction

The mortgage insurance deduction is a tax break that allows homeowners to deduct the amount they pay for mortgage insurance premiums from their taxable income. Mortgage insurance is typically required when a homeowner has less than 20% equity in their home, and it protects the lender in case the homeowner defaults on their loan. To qualify for the mortgage insurance deduction, you’ll need to meet certain criteria.

First, you must have a mortgage on your primary residence or a second home. Second, the mortgage insurance must have been provided by the Department of Veterans Affairs, the Federal Housing Administration, or the Rural Housing Service, or by a private mortgage insurance company. There are income limits to qualify for this deduction. For tax year 2022, the mortgage insurance deduction begins to phase out for taxpayers with adjusted gross incomes (AGI) over $100,000, and it’s fully phased out for taxpayers with AGI over $110,000. It’s important to keep accurate records of your mortgage insurance premiums, as you’ll need to report the amount of premiums paid on your tax return. You should receive a Form 1098 from your mortgage lender, which will show the amount of mortgage insurance premiums you paid during the year

Points deduction

The points deduction is a tax break that allows homeowners to deduct the points they paid when they obtained their mortgage from their taxable income. Points, also known as loan origination fees or loan discount fees, are a one-time fee paid to the lender when you close your mortgage. To qualify for the points deduction, you’ll need to meet certain criteria.

First, the points must have been paid when you obtained a mortgage to build or improve your primary residence or a second home.

Second, the points must have been a percentage of the loan amount, and the loan must have been used to build your primary residence. It’s important to note that not all loan fees are deductible as points. For example, fees for services such as appraisals, title searches, and property taxes are not deductible as points. It’s also important to keep accurate records of the points you paid, as you’ll need to report the amount of points paid on your tax return. You should receive a Form 1098 from your mortgage lender, which will show the amount of points you paid during the year.

Construction-related tax breaks

If you’re building a new home, you may be eligible for tax breaks related to the construction process. Here are some of the tax breaks you may be able to take advantage of:

Energy-efficient home tax credit

Energy-efficient homes are increasingly popular, and for good reason. Not only do they help the environment, but they also save homeowners money on their energy bills. To encourage homeowners to invest in energy-efficient homes, the federal government offers energy tax credits.

Homeowners can be eligible for a tax credit up to 30% of the cost for renewable energy improvements related to geothermal heat pumps, small wind turbines, solar energy systems, fuel cells, and biomass fuel stoves. Other upgrades include air-source heat pumps, central air conditioning, hot water heaters, and circulating fans and may give you a tax credit of 10% of the cost up to a total of $500 or for a specified amount between $50 and $300 depending on the improvement made. The credits are good through 2032 and then step down in 2033 and 2034 after which they are scheduled to go away. To be eligible for the tax credit, homeowners must have these systems installed before the end of the tax year.

To qualify for the energy-efficient home tax credit, you’ll need to meet certain criteria. The improvements must have been made to your primary residence, and they must have been made before December 31, 2023. The amount of the credit and the eligibility criteria can vary depending on the type of improvement and when it was made. For example, the solar tax credit is scheduled to decrease from 26% to 22% for installations made in 2023 and to expire after this year. It’s important to consult with a tax professional to determine your eligibility for the credit and the amount you can claim.

Home office deduction for self-employed individuals

The home office deduction is a tax break that allows self-employed individuals to deduct the expenses associated with their home office from their taxable income. For example, if you’re self-employed and you use a portion of your home exclusively for your business, you may be able to deduct a portion of your home-related expenses, such as rent, mortgage interest, property taxes, and utilities, as a business expense.

The amount of the deduction is based on the percentage of your home that is used for business purposes. To qualify for the home office deduction, you must meet certain criteria. The space you use for your home office must be used exclusively and regularly for business purposes and it must be your principal place of business.

Additionally, the space must be used for administrative or management activities and you must not have another location where you conduct substantial business activities. It’s important to note that the home office deduction is only available to self-employed individuals, and it cannot be claimed by employees who work from home for their employer. In addition, the deduction is subject to certain limitations and restrictions, so it’s important to consult with a tax professional to ensure you’re taking advantage of all the tax breaks available to you.

Depreciation deduction for rental properties

Depreciation is a tax break that allows owners of rental properties to deduct the cost of the property over time as it depreciates in value. For example, let’s say you own a rental property that you purchased for $200,000. You can deduct the cost of the property over a period of 27.5 years, which is the useful life of residential rental property according to the IRS. This means that you can deduct $7,273 per year ($200,000 divided by 27.5) from your taxable income.

In addition to the cost of the property, you can also deduct the cost of improvements and repairs that are necessary to maintain the rental property. It’s important to note that depreciation is a non-cash expense, which means that you don’t have to spend any money to claim the deduction. However, if you sell the rental property, you’ll need to pay back a portion of the depreciation you claimed over the years through a tax known as depreciation recapture.

Local tax incentives

In addition to federal tax breaks, you may also be eligible for local tax incentives. Here are some of the incentives you may be able to take advantage of:

Property tax abatement

Property tax abatement for new home construction is a program in which homeowners are granted a reduction in their property tax bill for a certain period of time. This reduction is intended to encourage individuals to build new homes, which can help stimulate economic growth in the area. This abatement would provide a significant financial benefit to the homeowner, which could help offset some of the costs associated with building a new home. Additionally, the abatement could encourage other individuals to build new homes in the area, which could lead to increased economic activity and development. It’s important to note that property tax abatement programs can vary significantly from city to city, and homeowners should carefully review the specific requirements and eligibility criteria before participating in the program.

To stimulate community revitalization, the City of Cincinnati, OH has a Residential Tax Abatement Program for improvements on a property, including new construction and renovation that increases the property’s value. The abatement allows owners to pay taxes on the pre-improvement value of their property for 10-15 years. The tax abatement benefits will stay with the property throughout the abatement period and can transfer to any new property owner within the approved time period. Properties that meet LEED or Living Building Challenge (LBC) standards may receive longer abatement terms and/or higher maximum abatements.

The city of Syracuse, NY provides a 10-year exemption from City and School taxes. During the first seven years, the property owner receives a 100 percent exemption on the increased assessment following the new construction; the exemption amount is phased out over the remaining three years. This exemption period can be extended if the home is LEED-certified by an accredited professional.

Whenever I start a new project, trust me, one of the first things I ask about is if there are any local tax incentives, and what they are. Don’t be lazy. Check for those in the local community where you want to build.

Reduced permit fees

One example of reduced permit fees for new home construction could be a policy implemented by a local government to incentivize the construction of energy-efficient homes. Under this policy, a builder or homeowner who is constructing a new home that meets certain energy efficiency standards would be eligible for a reduction in their permit fees. The standards could include requirements for insulation, windows, heating and cooling systems, and appliances, among others. The rationale behind this policy is that energy-efficient homes consume less energy, which leads to lower utility bills for homeowners and less strain on the local power grid. Additionally, energy-efficient homes can help reduce greenhouse gas emissions, which can benefit the environment. By offering reduced permit fees for energy-efficient homes, the local government hopes to encourage more builders and homeowners to adopt these standards and build more sustainable homes

Sales tax exemption for building materials

An example of sales tax exemption for building materials used in new home construction could be a policy implemented by a state government to promote affordable housing. Under this policy, building materials purchased for use in the construction of new homes that meet certain affordability criteria would be exempt from sales tax. The criteria could include factors such as the size of the home, the number of bedrooms, and the income level of the prospective homeowners.

The rationale behind this policy is to reduce the cost of building affordable housing and make it more accessible to low and middle income families. By exempting sales tax on building materials, the government hopes to incentivize builders and developers to construct more affordable homes, which in turn can help alleviate the shortage of affordable housing in the state. This policy can also benefit the economy by creating jobs in the construction industry and increasing the supply of housing, which can lead to increased economic activity and growth.

Are there other tax breaks available?

Actually there are! Tax deductions for home improvements that increase resale value and for home improvements related to medical care. However, these might be trickier deductibles to qualify for.

Conclusion. Building a new home can be an exciting but expensive process. Knowing what tax breaks are available can help you save money and make your new home more affordable. However, it’s important to consult a tax professional to ensure you’re taking advantage of all the tax breaks available to you.