Are you thinking about building a house as an investment property but don’t know where to start? Look no further! This guide will take you through the essential steps to make constructing your home into a profit.

How to turn your home into an investment property?

In total, you have three options available; to sell it, rent it or both! All of the options can be feasible if you properly evaluate investment potential, stick to the construction budget and timeline, and find reliable tenants or good buyers.

Note though, if an investor earns rental income from a property, they must report it as income to the IRS. However, they are allowed to deduct relevant expenses from the rental income, such as repairs and maintenance costs. The difference between the rental income and expenses is reported as self-employment income. When an individual sells an investment property for more than what they originally paid for it, they have a capital gain, which must be reported to the IRS.

There are, on the other hand, some tax benefits you should be aware of. By taking the square footage of the part of our property that is dedicated to the rental space, you can take advantage of one of the most important benefits of being a rental real estate taxpayer. As a rental real estate investor, you get to claim depreciation on the portion of the property that is for business purposes.

As someone who has been in this business for many years, the greatest advise I can give you is to build the type of property that is already in demand on the market, rather than the type that you believe future buyers and tenants require. A highly personalized house is a terrific idea if you intend to live in it for the rest of your life, but if you intend to resell or rent it out, be aware that this is typically a deterrent.

What is an investment property?

Investment property is one that is not meant to be a primary residence. It generates some form of income: dividends, interest, rents, or even royalties, that fall outside your regular business. The way in which an investment property can be used has a significant impact on its value. In this regard, we distinguish residential, commercial, and mixed-use properties.

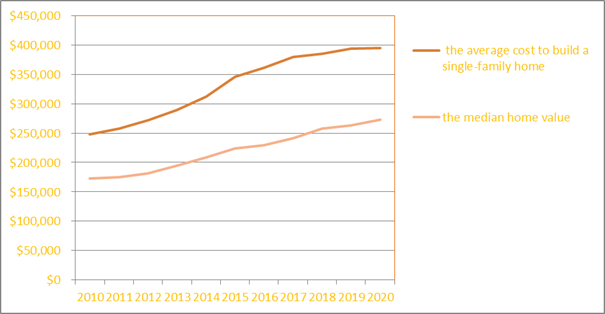

If you’re looking to make some extra income or diversify your investment portfolio, building a house as an investment property may be a smart move. By renting out your home, you can earn regular rental income and potentially build equity in the property over time. Additionally, you can sell it and earn on a difference between construction price and market price.

The process of building an investment property involves several steps, including evaluating your home’s rental and reselling potential, preparing your home for renting or selling, finding reliable tenants or buyers, maintaining the property, and managing the rental. In this article, we’ll take a closer look at each of these steps and provide you with the information and resources you need to make your home a profitable property.

How to evaluate house’s investment potential?

Evaluating investment potential is the first step in building an investment property. It’s important to consider the factors that make a property attractive to renters and buyers. This includes location, condition, and amenities. Homes in desirable neighborhoods, close to good schools, and with access to public transportation tend to be more attractive to renters and buyers alike. Additionally, homes with features such as modern appliances, ample storage space, and outdoor areas like decks or patios can also be more appealing.

When evaluating location, consider its proximity to popular attractions, shopping, dining, and transportation. Is it located in a desirable neighborhood with low crime rates and good schools? These factors can affect the demand for your rental property and ultimately its resale potential.

Adding amenities is also crucial in determining its rental and resale potential. Are you planning any unique features such as a pool or a fireplace? These can be strong selling points for renters or buyers. Additionally, consider the number of bedrooms and bathrooms, as well as the amount of storage space. All of these factors can play a role in determining the rental value and resale potential of your home.

How to prepare a home for renting or selling?

Once you’ve evaluated investment potential, it’s time to prepare for renting or selling. One of the first steps in this process is to clean and tidy it up. This can help to make it more attractive to potential renters or buyers. Remove any unnecessary items, organize your belongings, and consider hiring a professional cleaning service to give your home a deep clean.

When it comes to selling your home, staging can also be an effective way to make it more attractive to buyers. Consider hiring a professional stager or doing it yourself by arranging furniture and décor in a way that highlights your home’s best features. Additionally, make sure your home is well-lit, and consider adding fresh flowers or plants to add a touch of warmth and personality.

Finally, it’s important to establish a reasonable rent or selling price for your home. This involves researching the local rental and real estate market and taking into account the size, location, and condition of your home. Consider working with a real estate agent or property management company to help you determine the appropriate rent or selling price.

How to find reliable tenants or good buyers?

Finding reliable tenants or buyers is crucial when turning your home into an investment property. One of the first steps in this process is to advertise your property to attract potential renters or buyers. Consider listing your property on popular real estate websites or working with a real estate agent to help you find interested parties.

When it comes to finding reliable tenants, it’s important to conduct thorough background checks to ensure that they are responsible and able to pay rent on time. This can include checking their credit score, employment history, and references from previous landlords. Additionally, it’s important to interview potential renters to get a sense of their personality and ensure that they will be a good fit for your property.

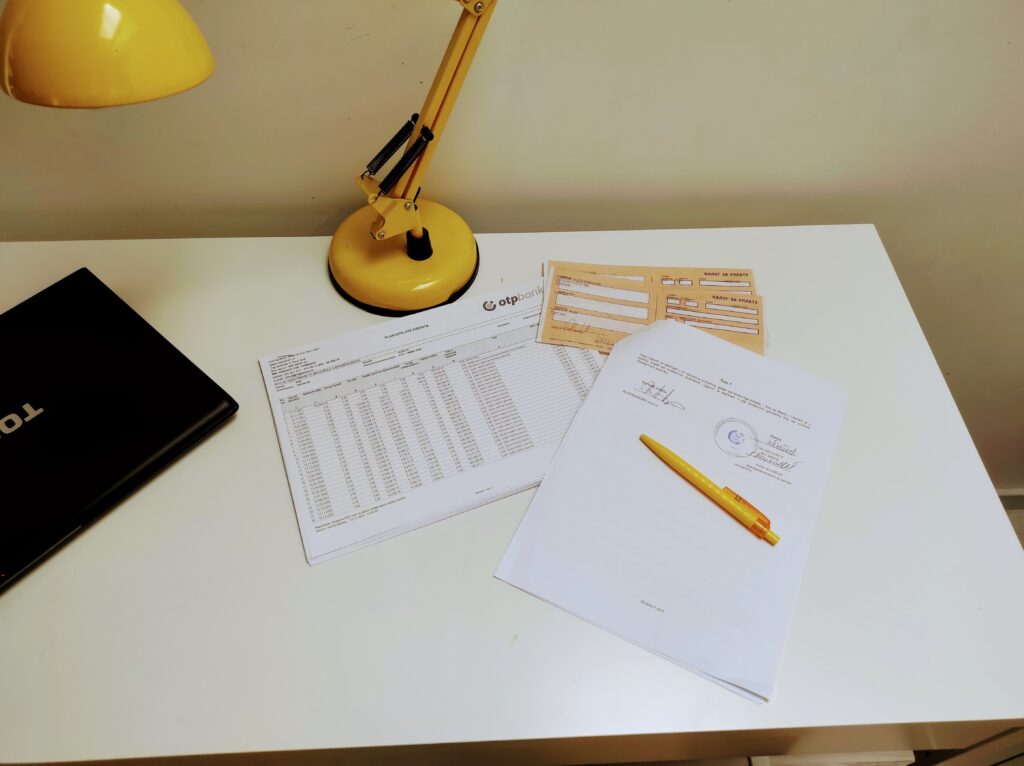

Once you’ve found reliable tenants, it’s important to create a lease agreement that outlines the terms of the rental agreement. This includes the length of the lease, the monthly rent amount, any security deposits or fees, and the rules and regulations of the property. Consider working with a lawyer or property management company to ensure that your lease agreement is legally binding and protects both you and your tenants.

When it comes to finding reliable buyers, it’s important to work with a real estate agent or property management company to help you navigate the selling process. They can help you to price your home appropriately, market your property to potential buyers, and negotiate the sale on your behalf.

How to maintain your investment property?

Maintaining your investment property is crucial for ensuring its long-term success and profitability. One of the first steps in this process is to set up a maintenance schedule. This can include regular inspections, cleaning services, and preventative maintenance tasks such as checking for leaks or changing air filters. Consider working with a property management company to help you establish and maintain a maintenance schedule.

Dealing with repairs and emergencies is also a key part of maintaining your investment property. It’s important to address any issues as soon as possible to prevent them from becoming more serious or causing further damage. Consider working with reliable contractors or service providers to help you quickly and efficiently handle repairs and emergencies.

Handling tenant complaints and issues is also an important part of maintaining your investment property. It’s important to listen to your tenants’ concerns and address them in a timely and respectful manner. This could include issues with noise, repairs, or disputes with other tenants. Consider establishing clear communication channels and a process for handling complaints and issues to ensure that your tenants feel heard and valued.

Additionally, it’s important to stay up-to-date on local laws and regulations related to rental properties. This can include zoning regulations, safety codes, and tenant rights. Consider working with a lawyer or property management company to ensure that you are complying with all applicable laws and regulations.

Managing Your Investment Property

Managing an investment property can be a complex and time-consuming process. One of the first decisions you’ll need to make is whether to self-manage your property or hire a property management company. Self-management can give you more control over your property and potentially save you money, but it also requires a significant amount of time and effort. Hiring a property management company can be more expensive, but it can also save you time and help you to avoid common pitfalls and mistakes.

Understanding landlord-tenant laws and regulations is also an important part of managing your investment property. These laws can vary depending on your location, but they typically cover issues such as rent increases, security deposits, evictions, and tenant rights. Consider working with a lawyer or property management company to ensure that you are complying with all applicable laws and regulations.

Collecting rent and handling finances is another important aspect of managing your investment property. It’s important to establish clear and consistent procedures for collecting rent, handling late payments, and tracking expenses. Consider working with a bookkeeper or accountant to help you manage your finances and stay organized.

Handling lease renewals and terminations is also an important part of managing your investment property. It’s important to communicate clearly with your tenants about their lease terms and ensure that you follow all applicable laws and regulations when it comes to renewals and terminations. Consider establishing a process for handling lease renewals and terminations to ensure that they are handled fairly and consistently.

Conclusion. Turning your home into an investment property can be a smart and profitable decision, but it requires careful planning and execution. In this article, we’ve covered several key steps involved in the process, including evaluating your home’s investment potential, preparing your home for renting or selling, finding reliable tenants or buyers, maintaining your investment property, and managing your property effectively. It’s important to remember that turning your home into an investment property is a long-term commitment that requires ongoing effort and attention. However, if done correctly, it can provide you with a reliable source of passive income and a valuable asset for your financial future. If you’re interested in turning your home into an investment property, we encourage you to take the first step and start exploring your options. With careful planning, research, and execution, you can turn your home into a successful investment property and achieve your financial goals. Good luck!