What is included in construction loan?

Here are the different elements that construction loan includes:

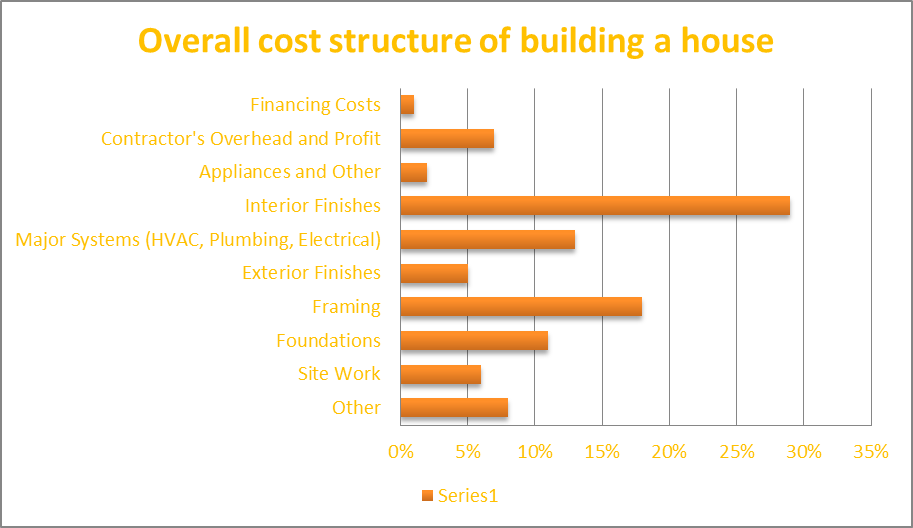

- Purchasing land: If you are building a new property, you may need to purchase land to build on. The construction loan may includes cost of the land.

- An existing property for re-development: If you are renovating an existing property, you may need to purchase the property before you can begin the renovation. The construction loan may incudes cost of purchasing the property.

- Permits and planning applications: Before you can begin construction or renovation, you may need to obtain permits and planning applications from the relevant authorities. The construction loan may includes cost of these permits and applications.

- Construction materials: The materials needed to build or renovate a property can be expensive, so the construction loan may includes cost of these materials.

- Construction labor: The construction loan may also includes cost of the workers needed to build or renovate the property.

- External services, such as architects and engineers: You may need to hire external services, such as architects and engineers, to design and plan the property. The construction loan may also includes cost of these services.

Traditional Bank Loans

The most common type of construction financing is a traditional bank loan. Banks and other financial institutions typically offer these loans and they are secured by the property being built. Traditional bank loans typically have relatively low interest rates, but they can be difficult to qualify for, especially for smaller construction projects.

To qualify for a traditional bank loan, borrowers will need to have a good credit score, a solid business plan, and a significant down payment. In addition, the property being built will need to meet certain criteria, such as having a strong potential for resale value.

Private Lending

For those who cannot qualify for a traditional bank loan, private lending may be an option. Private lenders are individuals or groups of investors who provide financing for construction projects. Private lenders typically charge higher interest rates than traditional banks but may be more willing to work with borrowers who have less-than-perfect credit or who are financing smaller projects.

According to my own experience, this is the least known source of financing, but unjustified. One advantage of private lending is that the process is often faster and more flexible than traditional bank lending. Private lenders can often provide funding more quickly, and they may be willing to negotiate the terms of the loan to meet the needs of the borrower.

Government Programs

In addition to traditional bank loans and private lending, there are also several government programs available to help finance construction projects. These programs are typically designed to promote economic development and job creation, and they often have more lenient requirements than traditional bank loans.

One popular government program is the Small Business Administration‘s (SBA) loan program. This program provides funding for small businesses, including those in the construction industry, and can be used for a variety of purposes, including financing new construction projects.

Another government program is the HUD program, which provides financing for the construction of multifamily housing. This program is designed to promote affordable housing and can provide significant financing for qualified projects.

In conclusion, a construction loan can include various elements such as purchasing land, buying an existing property for redevelopment, permits and planning applications, construction materials, construction labor, and external services. Traditional bank loans, private lending, and government programs are the common options for financing construction projects. Each option has its own requirements and advantages, so it is important to carefully consider the options and choose the one that best suits your needs and financial situation. Whether you are a small business owner or an individual seeking to build your dream home, understanding the components of a construction loan and the available financing options is essential for a successful construction project.