The outlook for house construction cost in 2024 is not optimistic. The price increase is very likely, in average 3.5%, with slowing spending expected across the board except for educational construction. The cost of building a house in 2023 is expected to be higher than in previous years. The rate of increase may slow down compared to 2022. However, it is essential to keep in mind that the cost of building a house depends on various factors, including location, design, and building size.

House Construction Cost In 2024

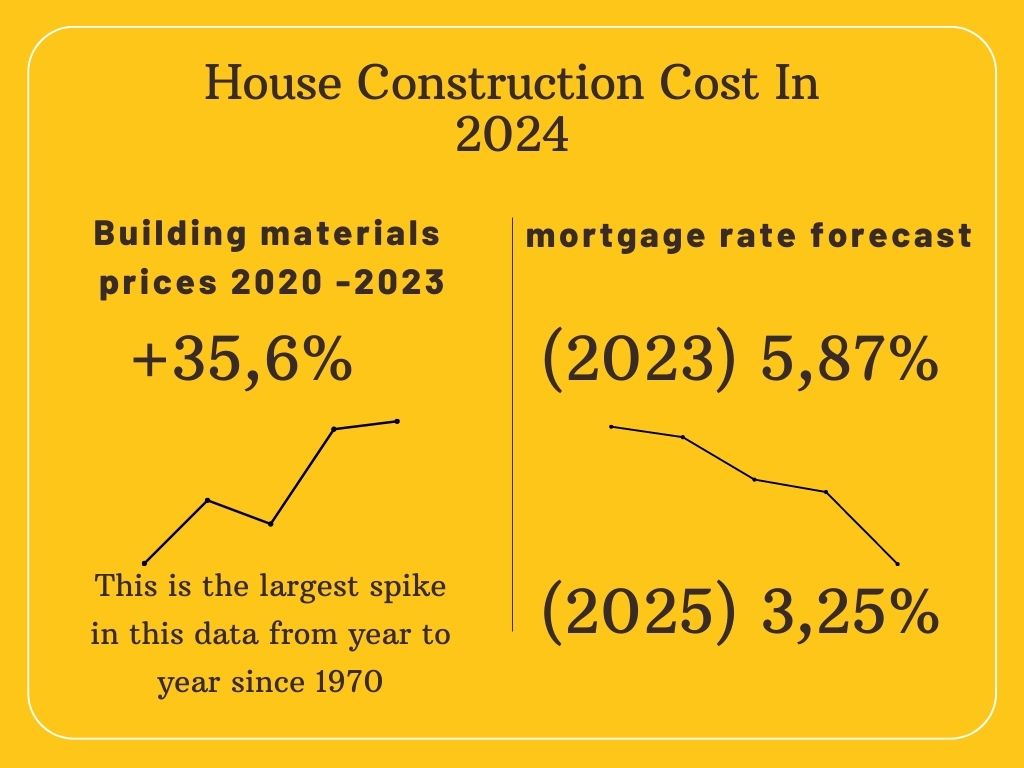

According to various sources, the average cost to build a house in 2023 ranges from $270,000 to $460,000. This depends on the location, design, and building size. The cost of building materials is a significant factor in the pricing. It has been increasing over the past few years. Recent data from the U.S. Census Bureau shows that construction costs went up by 17.5% year-over-year from 2020 to 2021. This is the largest spike in this data from year to year since 1970. Building materials prices are up 19.2% year over year and have risen 35.6% since the start of the pandemic.

Experts predict that construction costs will continue to rise in 2023. However, the rate of increase will slow down compared to previous years. According to a report by Turner & Townsend, residential building materials are expected to cost 7% more in 2023 than they did in 2022. However, the outlook for 2024 is less optimistic, with slowing spending expected across the board except for educational construction. The AIA’s Consensus Construction Forecast panel, comprising leading economic forecasters, is projecting commercial construction to slow to less than 1% in 2024. Commercial spending will drop 1.4% across all sectors with spending cuts of nearly 3% in each.

FAQ

- What is the expected increase in US home prices for 2023?

US home prices are expected to increase by 1.2% in 2023.

- How is the current state of the housing market?

The housing market has cooled from previous highs, but demand remains strong with limited inventory.

- What is the median home price in California at the moment?

California’s median home price increased for the first time in seven months, reaching $791,490 in March 2023.

- How do interest rates impact the housing market?

At its latest December 14, 2022 meeting, the Fed raised rates yet again, this time by a half percentage point, taking rates to a targeted range of between 4.25% and 4.5%.

Like everyone else, construction is feeling the pain. In December 2022, a 30-year fixed-rate mortgage ran close to 7%. Even if soaring prices for new homes begin to drop, monthly mortgage payments are likely to remain high. Construction costs are projected to increase well into 2023.

- What factors can impact housing prices and consumer confidence?

Inflation could significantly reduce the bill’s buying power. Whether for a homeowner or a business, the cost of loans makes all construction projects more expensive— especially at a time when labor shortages have driven wages higher and construction inputs prices are up more than 40% in last few years.

How will Current Trends in the Housing Market Influence The House Construction Cost In 2024

The US housing market has been experiencing a lot of changes in recent years. According to the National Association of Realtors (NAR), home prices are expected to increase by 1.2% in 2023.

However, there are mixed opinions among experts on whether the historically tight housing market will loosen or not. The market has cooled significantly from its previous highs. The demand for housing remains strong, with homes selling quickly and at improved sales-to-list price ratios, and limited inventory.

In April 2023, U.S. home prices were down 4.2% compared to last year, selling for a median price of $400,378. The number of homes sold was down 25.5% year over year. There were 411,730 homes sold in April this year, down 552,880 homes sold in April 2022.

The California Association of Realtors (CAR) has released its report on the California housing market, indicating that higher interest rates contributed to a small drop in home sales in March 2023. Despite the dip, the demand for housing in the state remains strong. Homes are selling quickly and at improved sales-to-list price ratios, and limited inventory. California’s median home price also recorded a healthy increase on a month-to-month basis. This is for the first time in seven months, reaching $791,490 in March 2023.

Heading into 2023, most housing analysts were on the bearish side. Among the 27 major forecasters, 23 expected national home prices to fall in 2023. Mainly under the weight of spiked mortgage rates. However, through the first few months of 2023, these bearish views haven’t manifested.

Factors Influencing Housing Market and House Construction Cost In 2024

Supply and demand

The factors that typically impact house prices include supply and demand, economic growth, population growth, and employment rates. The law of supply and demand is a basic economic principle that explains the relationship between supply and demand. When the demand for housing is high, but supply is low, home prices often rise. When there is a glut of housing available in a market, homeowners may lower their prices due to less demand in the market.

Economic growth

Economic growth is another factor that affects the housing market. Rising home prices likely encourage additional construction spending to take advantage of higher prices, leading to more robust economic growth. A decline in housing prices is likely to depress construction spending, leading to more anemic economic growth.

Population growth

Growth of population and particularly the growth in the number of households, leads to a growth in housing demand. Population decline might lead to a decrease in housing demand.

Employment rates

Employment rates also have a significant impact on the housing market. The U.S. national labor market has recovered from the effects of the 2007-2009 recession. However, despite the national labor market recovery, significant regional variation remains. Recent economic research highlights links between regional labor and housing markets. The correlation between county-level unemployment rates and changes in housing prices has been reviewed. It has been found that areas with lower unemployment rates before the recession experienced smaller upticks in unemployment during the recession. The authors theorized that one reason for the disparity in unemployment rate increases could be related to the housing supply.

The broader economy often impacts a person’s ability to buy or sell a home, so in slower economic conditions, the housing market can struggle. For example, if employment or wage growth slows, then fewer people might be able to afford a home or there may also be less opportunity to relocate for new employment.

Factors Influencing Future House Prices

The housing market is influenced by various factors, including interest rates, housing inventory levels, and demographic shifts. Here are some projected changes that may impact the housing market in 2024:

Interest Rates

According to Long Forecast, the 30-year mortgage rate forecast for January 2024 is expected to be around 5.87%, with a maximum interest rate of 6.10% and a minimum of 5.56%. The average interest rate for May 2024 is predicted to be around 5.45%, with a maximum of 5.66% and a minimum of 5.16%. Predictions are that the interest rate will fall back to 3.75% at the end of 2024 and 3.25% in 2025.

Housing Inventory Levels

Housing inventory levels are expected to remain tight through at least 2024, according to National Mortgage Professional. However, Zillow predicts that inventory should return to a monthly average of 1.5 million units or higher in 2024, according to the largest group (38%) of respondents to Zillow’s survey of housing market experts.

Demographic Shifts

Fastmarkets reports that the housing market is still under-supplied despite slower population growth. While this demographic change is a negative, the market has not yet reached its full potential. The changing demographics by 2030 will be essential for homeowners to consider the total cost of homeownership when making purchasing decisions.

Zillow predicts that home values will increase by 3.4% in 2024, which is less than the 3.5% increase expected in 2023. Moody’s analytics expects prices to drop 10% from June to summer 2024, but if a recession hits, an increasingly likely scenario, prices could fall even further. However, Forbes predicts that for-sale homes will remain high-priced, with the national annual median price for 2023 expected to advance another 5.4%—less than half the pace of 2022.

Overall, the housing market is expected to remain tight through at least 2024, with interest rates remaining relatively stable. Home prices may increase at a slower pace, but they are still expected to remain high. Demographic shifts will also play a role in the housing market, with changing demographics by 2030 being essential for homeowners to consider the total cost of homeownership when making purchasing decisions.

Expert Predictions And Forecasts For House Construction Cost In 2024

forecasts and predictions

Reference forecasts and predictions from reputable sources, such as real estate associations, economists, or housing market analysts:

Zillow’s forecast model expects US home prices, as measured by the Zillow Home Value Index (ZHVI), to jump 4.8% between April 2023 and April 2024.

The latest Real Estate Economic Forecast from the Urban Land Institute (ULI) projects positive but slower growth in the near term and a return to stronger growth in 2024, with inflation remaining a challenge of uncertainty.

Economists and housing experts polled in the latest Zillow Home Price Expectation (ZHPE) survey expect home prices to fall 1.6% through Dec. 2023, but prices are expected to grow at a steady pace starting in 2024, with an average clip of 3.5% per year through 2027.

Moody’s predicts that nationally home prices will decrease about 4% both in 2023 and in 2024. However, Goldman Sachs predicts that national home prices would fall just 2.6% in 2023.

Zillow expects 37 regional housing markets to see at least a 7% home price jump between April 2023 and April 2024.

However, other experts predict that home prices will fall in 2023 and 2024, with one analyst who predicted the 2008 housing bust seeing U.S. home prices falling in both 2023 and 2024. Moody’s Analytics also expects U.S. home prices to decline between 0% and 5% nationally, with that forecast moving to 5% to 10% if a recession hits.

potential drivers of house price

Here are some notable insights or analysis provided by experts regarding the potential drivers of house price changes in the upcoming year. Interest rates have been the highest in decades, and the relationship between interest rates, inflation, and home prices is intertwined. Rising inventory levels and plummeting demand could lead to substantial home price corrections. Challenging affordability conditions could result in homes taking longer to sell and for-sale homes remaining high-priced. Total housing starts, an indicator of new construction, are projected to decrease over the next couple of years. Population growth is a key factor that impacts housing supply and demand. Government policies that encourage home buying could boost demand for housing.

Overall, the housing market is sending clearer signals that historically low mortgage rates and the home-buying frenzy have come to an end. While there are varying opinions and forecasts for house price growth in 2024, it is important to keep in mind that the housing market is subject to many external factors that can impact supply and demand, interest rates, and affordability.

my opinion

I stated numerous issues in the text, and I read and left out even more. Partly due to a lack of space, and partly due to my considering it as pure speculation. What am I left with at the end of the day? The cost of building a house will rise by 3 to 4% in 2024 and continue at a similar rate in subsequent years. And property values will rise accordingly. The price increase in 2024 and further growth in the following years will not favor purchasers or even investors because construction input costs will rise at a faster rate.

Regional Variations In House Construction Cost in 2024

We expect the housing market to experience significant changes in the coming years, with some regions seeing notable price changes. Let’s see some insights into specific regions or cities that we are expecting to see notable price changes in 2024. Also as regional factors that could influence house prices.

Some of the biggest home price upticks between March 2023 and March 2024, Zillow are expecting to occur in markets like Knoxville (+4.5% forecasted).

However, Moody’s Analytics predicts that 178 regional housing markets are likely to see home prices decline in 2023. They predict the biggest 2024 home price drops in The Villages, Fla. (-6.33%); Punta Gordo (-5.71%); Cape Coral, Fla. (-4.58%); and Lake Havasu, Ariz.

In conclusion, the limited housing supply is a major constraint to rising sales, contributing to the drop in existing-home sales. Tight inventory issues, in part, are also keeping prices from dropping off. This is perpetuating affordability challenges for many, especially first-time homebuyers. The rising cost and consequences of climate change will also impact the housing market in 2024. Homebuyers and builders will have to factor in the costs of building homes that are resilient to climate change and extreme weather events. It’s important to note that real estate trends vary by region. This means that home prices in your area might not be following the trends in 2023 or 2024. Timing the housing market is very difficult. So waiting around to get the best possible deal might not be the best strategy.