In this article, we explore the various costs involved in building a house, including the amount of cash required for a down payment, how to estimate the appraised value of the property, and how much money to set aside for unforeseen expenses. By the end of this article, you’ll have a better idea of how much money you need to save before you start building your soulful house.

In total, we can say that saving $140,000 in advance for all necessary payments is required to build a house of typical size. Of course, the amount of money required varies based on a wide range of factors, and it does not have to be close to this figure in your specific case. If you read the article all the way through, you will understand how we got this figure.

When estimating the cost of building your own home, keep the following elements in mind: the cost of materials and labor, permits and other fees, and the time it will take to finish the project, which is factored into the cost of renting and/or purchasing equipment. You’ll need enough cash to pay the upfront fees as well as a buffer in case your house goes over budget.

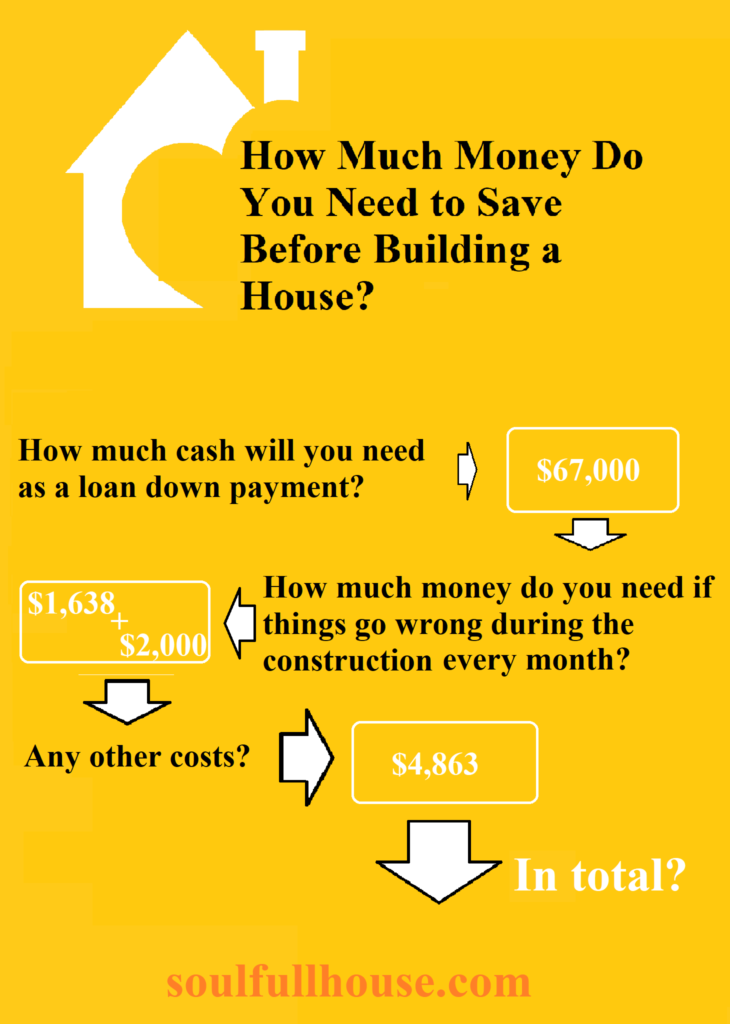

How much cash will you need as a loan down payment?

The amount you must pay is determined by the size and complexity of the home, as well as the desirability of the neighborhood in which you choose to live (this refers to the price of the land, but it is not the subject of this calculation). The National Association of Home Builders estimates that the national median price per square foot for building a house in 2021 was $128. All labor and materials, as well as permits and fees, are included in this price. The average size of newly built houses in the United States in 2021, according to the United States Census Bureau, was 2,624 square feet. We eventually arrive at a rough estimate of $336,000.

A construction-to-permanent loan is designed exclusively for those who are building their own houses. If you do not qualify for this sort of financing, you will have to obtain separate construction and mortgage loans. The standard down payment for these loans is 20% of the total cost of the home (an average of $67,000), but you may be able to negotiate a lower down payment based on your credit score and income (if you qualify for an FHA loan, you might only have to put down 3.5 percent).

The bank requires a down payment of either the construction cost or the appraised value. The average appraised value of newly built houses in the United States in 2021, according to CoreLogic, was $344,705. This is 6.3% more than the expected cost of building for the same properties. So, if the house appraises for more than the cost of construction, the bank will lend you the extra. Find a bank that sets loan amounts and cash down payments on appraised value rather than building cost to potentially lower the amount of cash you’ll need.

In either case, in order to figure out how much cash you will need as a down payment on your construction loan, you will need to know the amount the house will appraise for.

How can you find out how much the house will appraise for when it is built?

1. Analyze the Local Market: The first step in determining the value of a property after construction is to study the local real estate market. This includes researching current market trends, examining local housing prices, and calculating the average cost per square foot of properties in the same community. This will give you an indication of what the home’s estimated appraised value will be.

2. Consult an Appraiser: Consulting with an appraiser before building a house can also help determine the anticipated appraised worth. An expert appraiser will be able to examine the local market, the design of the home, and other criteria to provide an accurate estimate of the home’s appraised value (this will cost you about $400).

3. Analyze Comparable Homes: Examining comparable properties in the region can also give you an indication of the house’s likely appraised worth. This entails looking at recently sold comparable homes and comparing their features and location to the one in issue. This will aid in determining the home’s approximate assessed value.

4. Invest in High-Quality Materials: Investing in high-quality materials during the construction process might help to boost the home’s evaluated worth. Quality materials, such as high-grade lumber and long-lasting roofing materials, can boost the home’s appearance and increase its evaluated worth.

How much money do you need if things go wrong during the construction?

I know from experience that this is the budget item that is most frequently overlooked and can be the most difficult to fix. So pay close attention!

Add a reserve to your budget equivalent to 10% to 20% of the overall project cost to cover your expenses if you go over budget (let’s say 15%, which equals $50,000 in our average amount). If your wage cannot easily support the mortgage, you will need to save enough money to cover the mortgage for at least six to twelve months (some estimated time to find another suitable job). With a 4.5% interest rate and a 30-year fixed-rate mortgage, the monthly mortgage payment on a $335,872 construction loan with a 20% down payment would be around $1,638. (so between 10,000 and 20,000 dollars is needed). It’s also a good idea to have that six to 12 months’ worth of living expenses in an emergency fund.

Are there any other costs?

You may also be required to pay for a building permit, contribute to the price of the builder’s insurance, or pay taxes on the things purchased to build your home, depending on your state and local requirements. According to the National Association of Home Builders, the average cost of a single-family home building permit in the United States in 2021 was $4,863. This cost varies significantly depending on the location and size of the house.

To summarize. The purpose of this post was to give you an idea of the average amounts that figure in the process of determining the initial required amount that you must save before beginning the construction of the house, but more significantly, to explain how this amount is correctly calculated. We hope we have succeeded, but if you have any questions or comments, please contact us and we will gladly attempt to meet you.