Construction loans are a popular way of financing property building. They are short-term and high-interest mortgages that enable property owners to build, remodel or redevelop their homes. Banks and non-bank institutions finance construction loans through various credit lines. Each credit line has different loan requirements, including interest rates, down payment, and DTI ratio, making it important to understand these when obtaining a construction loan. In this blog post, we’ll explore six credit lines on the US financial market that you should consider when obtaining a construction loan, including the types of construction loans available and what they cover.

Who finances construction loans?

Construction loans are financed by banks, either commercially or through an agreement with another institution, as well as non-bank institutions. In this regard, we identify six different credit lines on the US financial market that should be considered when obtaining a construction loan:

- Commercial loans

- SBA loans

- VA loans

- USDA loans

- FHA loans

- Fannie Mae/Freddie Mac

Several of these credit lines are frequently available at the same bank, but they differ mostly in terms of the client they are meant for, and thus the loan elements such as the interest rate, down payment, and DTI ratio varies. Let’s dig a little further into these!

What is a construction loan?

A construction loan (also known as a development loan) is a short-term, high-interest mortgage that helps finance property building. Because the investment bears a bit more risk for the lender, the interest rate is often higher than on other loans. For example, because the home has not yet been built, the borrower may not have a home to offer as collateral. This is a bridging loan that is used to pay the expenditures of constructing new dwellings or redeveloping existing residential buildings. Construction loans can also be used to purchase a plot of land on which to build or to remodel an existing home.

What does a construction loan cover?

Construction loans can be used to pay for:

- Land

- An existing property for re-development

- Permits and planning applications

- Construction materials

- Construction labor

- External services, such as architects and engineers

1. Traditionally financed construction loans

These are meant for the broadest possible range of users and are thus the easiest to obtain; however, they are also the most financially demanding for the user, particularly when a 20% to 25% down payment is required. If you fall into one of the demographic groups that can apply for one of the subsidized credit lines discussed below, you should absolutely look into them.

2. SBA loans

These are often administered by banks, credit unions and other financial institutions. Yet, because they are supported by the Small Business Administration, they are less problematic for SBA lenders. SBA loans are intended for the purchase and renovation of fixed assets such as real estate. You can borrow up to $5 million and repay it over ten, twenty, or twenty-five years. SBA loans typically have some of the lowest interest rates available. The under-construction property serves as collateral. SBA loans are typically structured as term loans rather than commercial construction loans.

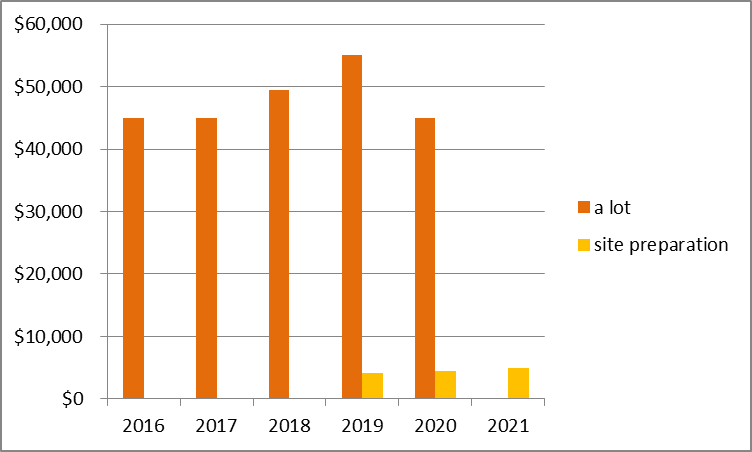

Rather than making interest-only payments throughout construction, you’ll make set payments for the duration of the loan. But, there may be exceptions to this, so check with your lender. SBA loans are made available through Certified Development Companies in each location. You can find one near you by visiting the SBA’s website. There is a lot of talk about how to save money. During your development, some lenders may offer loans that function similarly to construction loans, in that they pay out in installments and you only have to pay interest once building is completed. If you want to get this type of loan, talk to your lender frequently during the application process to ensure you understand the loan terms.

3. VA loans

These are government-sponsored programs that allow lenders to charge reduced down payments. Active-duty service members, veterans, and their surviving spouses can use a VA loan to purchase a home with no down payment, no mortgage insurance, and flexible credit requirements. You must, of course, meet the minimum service requirement, but if you do, the VA advises a maximum DTI ratio of 41%, with exceptions allowed if you have significant residual income.

4. USDA home loan

This is a zero-down-payment mortgage for homebuyers in eligible towns and rural areas. USDA loans are backed by the USDA Rural Development Guaranteed Housing Loan Program, which is run by the United States Department of Agriculture. The majority of the time, this is the case. Income restrictions to qualify for a USDA-guaranteed home loan offered by a partner lender vary by location and household size. Nonetheless, the borrower’s family income cannot exceed 115% of the county median income in which their new home is located. The monthly loan payment must be 29% or less of the borrower’s monthly income, including principal, interest, insurance, and taxes. Other monthly loan payments are limited to 41% of the borrower’s income.

5. FHA loans

These are designed for people with less-than-perfect credit, and they may be eligible for a Federal Housing Administration-backed construction loan. Most banks have higher qualifying minimums than FHA construction loans. As of October 2020, FHA standards were as follows: a minimum 3.5% down payment based on FICO® score and a DTI ratio of 43%. The borrower’s primary residence must be the property, and he or she must have a consistent income and proof of employment.

6. Fannie Mae, Freddie Mac, and the Federal Home Loan Banks (FHL Banks)

They have worked to increase house ownership among low and middle-income families, in deprived areas, and in general by utilizing unique affordable approaches. If the lender uses a Fannie Mae loan, the down payment might be as little as 3%, and while 45% is the conventional ceiling, lenders may accept a DTI ratio of up to 50% provided the borrower has good credit and enough mortgage reserves. The Federal National Mortgage Association (FNMA), also known as Fannie Mae, is a government-sponsored enterprise (GSE) in the United States that has been a publicly traded firm since 1968. Its objective is to satisfy federal Housing and Urban Development (HUD) housing goals.

Types of construction loans

Just as there are many sources of credit, there are various methods of obtaining construction loans, of which you should be aware of the most important aspects.

Construction-to-permanent loan

This is a construction loan that converts to a permanent mortgage after the home is constructed and ready for occupancy. C2P loans provide borrowers with additional flexibility by merging two forms of loans into a single transaction. If you have a construction-to-permanent loan, you only pay interest on the outstanding balance during construction, at an adjustable rate decided by the lender and pegged to the prime rate. The prime rate is a widely recognized benchmark based on the federal funds rate, which is regulated by the Federal Reserve. As the Fed rise rates, so will the interest rate on your construction-to-permanent loan.

When the construction phase is completed, the C2P loan changes into a regular 15- or 30-year mortgage with principal and interest payments. Small company owners and homeowners benefit from construction-to-permanent loans since they allow them to obtain two loans at once, rather than one for the construction period and another for funding the finished project. You only close once in this case and pay one set of closing costs. The loan allows the buyer to deal with only one round of application and paperwork, as well as the convenience of readily transferring to a mortgage once the home is completed.

Construction-only loan

This is a loan used to pay for building costs by disbursing funds in increments as project milestones are fulfilled; repayment terms are usually one year or less. A construction-only loan only covers the cost of building the home for the duration of the construction process. Once the house is built, the entire loan amount is usually required. Borrowers could pay cash or take out a separate mortgage to cover the amount.

Owner-builder construction loan (also sometimes known as DIY home build loans)

This is a loan that functions similarly to a construction-to-permanent or construction-only loan, but with one important distinction: the borrower is also the builder. An owner-builder loan is intended for those with construction experience who will be both the borrower and the leader of construction works. Because an owner-builder loan depends on the borrower to manage the construction of a home, it typically demands confirmation of licensing, experience, and overall expertise.

End loan or Construction Mortgage Loan

You can utilize this loan to fund the acquisition of land or the construction of a home on land you already own. Often, these loans are designed so that the lender pays a percentage of the finishing costs and you, the builder or developer, pay the remaining amount. Throughout construction, your cash will be released by the lender in a series of payments known as “draws.” The lender will usually need an inspection between draws to ensure that the project is progressing as anticipated.

You, as the borrower, are responsible for paying interest on the funds you use. This differs from a term loan, in which you receive a lump sum payment and subsequently pay interest on the entire amount. You are responsible for returning the total loan amount by the due date once your construction is completed and your interest has been paid. Construction loans typically have short periods since they represent the length of time required completing the project; a year’s term is common.

In conclusion, construction loans are a great option for those looking to finance the building or renovation of a property. With different credit lines available on the US financial market, borrowers can choose the loan that best suits their needs and financial situation. Commercial loans, SBA loans, VA loans, USDA loans, FHA loans, and Fannie Mae/Freddie Mac loans are the most common options available for borrowers. It is important to note that each loan type has different requirements and interest rates, so borrowers should do their research and speak with lenders to find the right fit for them. Remember, construction loans are short-term and high-interest mortgages, but they can be beneficial in the long run if you need funding for a new construction project.